Latest Version

Version

3.72.0

3.72.0

Update

May 14, 2025

May 14, 2025

Developer

Dave Operating LLC

Dave Operating LLC

Categories

Finance

Finance

Platforms

Android

Android

Downloads

19

19

License

Free

Free

Package Name

com.dave

com.dave

Report

Report a Problem

Report a Problem

More About Dave - Fast Cash & Banking

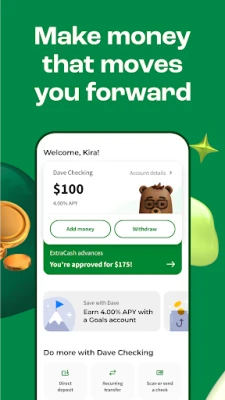

Take your finances to the next level with Dave.

Dave Membership Information

1-Dave is not a bank. Banking services provided by Evolve Bank and Trust, Member FDIC, or another partner bank, which issues the Dave Debit Card through a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved in 5 min, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers.

UP TO $500 IN 5 MIN OR LESS(1)

You could pocket up to $500(1) with ExtraCash™. There’s no credit check, interest, or late fees.

EXTRACASH™ 101

ExtraCash™ offers the ability to get up to $500.(1) The amount of money you can take (your eligibility) refreshes daily. We determine your eligibility using several data points—like your income history, spending patterns, and at least 3 recurring deposits. When you take ExtraCash™, you’ll agree to a settlement date to pay your outstanding balance.

ACCESS YOUR CASH INSTANTLY(2)

Get up to $500 when you download Dave, link a bank account, open your Dave Checking and ExtraCash™ accounts, & transfer it to your Dave Checking account. Your Dave Debit Mastercard® gives you instant, direct access to your money for hassle-free spending.

EARN 4.00% APY(3)

Add money to your Dave Checking account or Goals account to grow your cash with this high annual percentage yield. Managing your money with Dave & online banking makes saving simple.

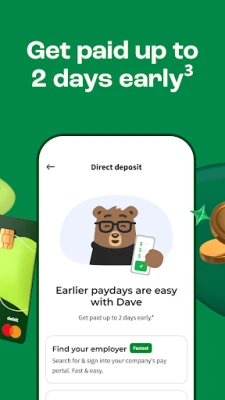

GET PAID EARLY

Get your paycheck up to 2 days early when you set up direct deposit.(4) A Dave Checking account streamlines your online banking experience, ensuring your money is available when you need it. A Dave Checking account makes handling money stress-free.

SAY GOODBYE TO PESKY FEES

Ditch hidden fees with Dave. You can even skip ATM fees at 40K+ MoneyPass ATMs.(5) Your Dave debit card keeps your money accessible without added costs. A Dave Checking account ensures you can withdraw your money anytime without excessive fees.

SAVE EFFORTLESSLY

Own your savings journey with a Goals account. Set up recurring deposits to build your savings steadily. Online banking through Dave simplifies saving your money for your future. The Checking account allows you to manage your money & expenses easily, keeping you connected to your savings at all times.

MAKE MONEY ON THE SIDE

Explore our Side Hustle board & easily apply for part-time roles, gig jobs, remote work, & more. Take Surveys that pay out instantly to your Dave Checking account. A debit card linked to your Checking account ensures you have quick access to your money, allowing you to track & transfer money effortlessly.

OUR MEMBERSHIP FEE

There’s a small monthly membership fee that gives you full access to our features, including ExtraCash™, Goals, & Surveys.(1) With Dave, you can monitor your money 24/7 & make transactions securely.

HAVE MORE QUESTIONS?

Send us an email at support@dave.com.

Disclosures related to the Dave app:

2-Express fees apply to select instant transfers.

3-Rates accurate as of 10/01/2024. The interest rates and annual percentage yields (APY) are variable and may change at any time at our discretion. No minimum deposit or minimum balance requirements. Fees could reduce earnings on the account.

4-Early access to direct deposit funds depends on timing and availability of the payroll files sent from the payer. These funds can be available up to 2 business days in advance of the scheduled payment date.

5-Out of network fees may apply.

General Terms

See the Dave Checking Deposit Agreement and Disclosures, Dave Goals Deposit Agreement and Disclosures, and the Dave ExtraCash™ Deposit Agreement and Disclosures for account terms and fees.

1-Dave is not a bank. Banking services provided by Evolve Bank and Trust, Member FDIC, or another partner bank, which issues the Dave Debit Card through a license from Mastercard®. ExtraCash amounts range from $25-$500, typically approved in 5 min, with an overdraft fee equal to the greater of $5 or 5%. Multiple overdrafts may be required. Not all members qualify for ExtraCash and few qualify for $500. ExtraCash is repayable on demand. Must open an ExtraCash overdraft deposit account and Dave Checking account. Up to $5 monthly membership fee for ExtraCash, Income Opportunity Services, and Financial Management Services. Optional 1.5% fee for external debit card transfers.

UP TO $500 IN 5 MIN OR LESS(1)

You could pocket up to $500(1) with ExtraCash™. There’s no credit check, interest, or late fees.

EXTRACASH™ 101

ExtraCash™ offers the ability to get up to $500.(1) The amount of money you can take (your eligibility) refreshes daily. We determine your eligibility using several data points—like your income history, spending patterns, and at least 3 recurring deposits. When you take ExtraCash™, you’ll agree to a settlement date to pay your outstanding balance.

ACCESS YOUR CASH INSTANTLY(2)

Get up to $500 when you download Dave, link a bank account, open your Dave Checking and ExtraCash™ accounts, & transfer it to your Dave Checking account. Your Dave Debit Mastercard® gives you instant, direct access to your money for hassle-free spending.

EARN 4.00% APY(3)

Add money to your Dave Checking account or Goals account to grow your cash with this high annual percentage yield. Managing your money with Dave & online banking makes saving simple.

GET PAID EARLY

Get your paycheck up to 2 days early when you set up direct deposit.(4) A Dave Checking account streamlines your online banking experience, ensuring your money is available when you need it. A Dave Checking account makes handling money stress-free.

SAY GOODBYE TO PESKY FEES

Ditch hidden fees with Dave. You can even skip ATM fees at 40K+ MoneyPass ATMs.(5) Your Dave debit card keeps your money accessible without added costs. A Dave Checking account ensures you can withdraw your money anytime without excessive fees.

SAVE EFFORTLESSLY

Own your savings journey with a Goals account. Set up recurring deposits to build your savings steadily. Online banking through Dave simplifies saving your money for your future. The Checking account allows you to manage your money & expenses easily, keeping you connected to your savings at all times.

MAKE MONEY ON THE SIDE

Explore our Side Hustle board & easily apply for part-time roles, gig jobs, remote work, & more. Take Surveys that pay out instantly to your Dave Checking account. A debit card linked to your Checking account ensures you have quick access to your money, allowing you to track & transfer money effortlessly.

OUR MEMBERSHIP FEE

There’s a small monthly membership fee that gives you full access to our features, including ExtraCash™, Goals, & Surveys.(1) With Dave, you can monitor your money 24/7 & make transactions securely.

HAVE MORE QUESTIONS?

Send us an email at support@dave.com.

Disclosures related to the Dave app:

2-Express fees apply to select instant transfers.

3-Rates accurate as of 10/01/2024. The interest rates and annual percentage yields (APY) are variable and may change at any time at our discretion. No minimum deposit or minimum balance requirements. Fees could reduce earnings on the account.

4-Early access to direct deposit funds depends on timing and availability of the payroll files sent from the payer. These funds can be available up to 2 business days in advance of the scheduled payment date.

5-Out of network fees may apply.

General Terms

See the Dave Checking Deposit Agreement and Disclosures, Dave Goals Deposit Agreement and Disclosures, and the Dave ExtraCash™ Deposit Agreement and Disclosures for account terms and fees.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

InterLink NetworkInterlink Labs Inc

Fashion Show: Makeup Wala Game 5Dress Up Games for Girls

ChatwiseChatWise UK Limited

App RaterApp Rater

Adult Block - Porn Blocker 5Mvsweb LLP

KreditBee: Personal Loan AppFinnovation Tech Solutions Pvt Ltd

PhotomathGoogle LLC

Kissht: Instant Personal LoansOnEMI Technology Solutions Pvt Ltd

Avada WordPress Theme Review: The Ultimate Website BuilderThemeFusion

10th 12th Pass Government Jobsgovt jobs

More »

Editor's Choice

InterLink NetworkInterlink Labs Inc

InterLink NetworkInterlink Labs Inc

How to Become a Mobile App Tester and Earn Money 5AN EPAM COMPANY

My11Circle Fantasy Cricket AppGames24x7

Vision11FIGMENT TECHNOKART PRIVATE LIMITED

Rummy Cash, Fantasy: MPL RummyMPL - Mobile Premier League

INDmoney - Stocks, Mutual FundINDmoney

App RaterApp Rater

Binance: Buy Bitcoin & CryptoBinance Inc.

Sun Crypto Buy & Sell CryptoSunCrypto

WP Theme

WP Theme Android

Android iOS

iOS Windows

Windows Mac

Mac Linux

Linux Play Station

Play Station Xbox

Xbox Steam

Steam Wordpress

Wordpress